The difference in approaches

Due to the fact that there is no federal system regulating auto insurance in the USA, this issue is difficult for many people. Every state is developing its own car insurance requirements.

You can buy car insurance in person or via the Internet from an insurance company; from an insurance agent or broker (the broker must have a license). Insurance is valid for half a year or for a year. It can be paid monthly, or it can be paid in a full amount. You often get a discount when you pay the whole sum at once. With annual insurance, it is guaranteed that the price will not rise. Choosing the 6-month policy, the price can raise each time after its ending.

The composition parts of car insurance

An insurance policy is a set of different types of coverage and every state is having its own insurance policy. There are many of them in the field of auto insurance. Consider two of them:

- Liability Coverage – compulsory liability. This is the most significant type of coverages, especially at states, where all responsibility falls on the culprit of the accident.

It should be borne in mind that in case when after an accident with big car damages, insurance of the person, responsible for this accident, does not cover all costs, the lacking amount will be claimed from the culprit at the court. On account of its coverage, all bank accounts of the family, shares, if any, the property owned, as well as the amount of one fourth of the money, earned by all members of the family in the next 10 years, are taken.

- Personal Injury Protection – it is compulsory in some states, like Florida and New York, and optional, for example, in California.

What is needed for auto insurance?

You need to provide the following data and documents:

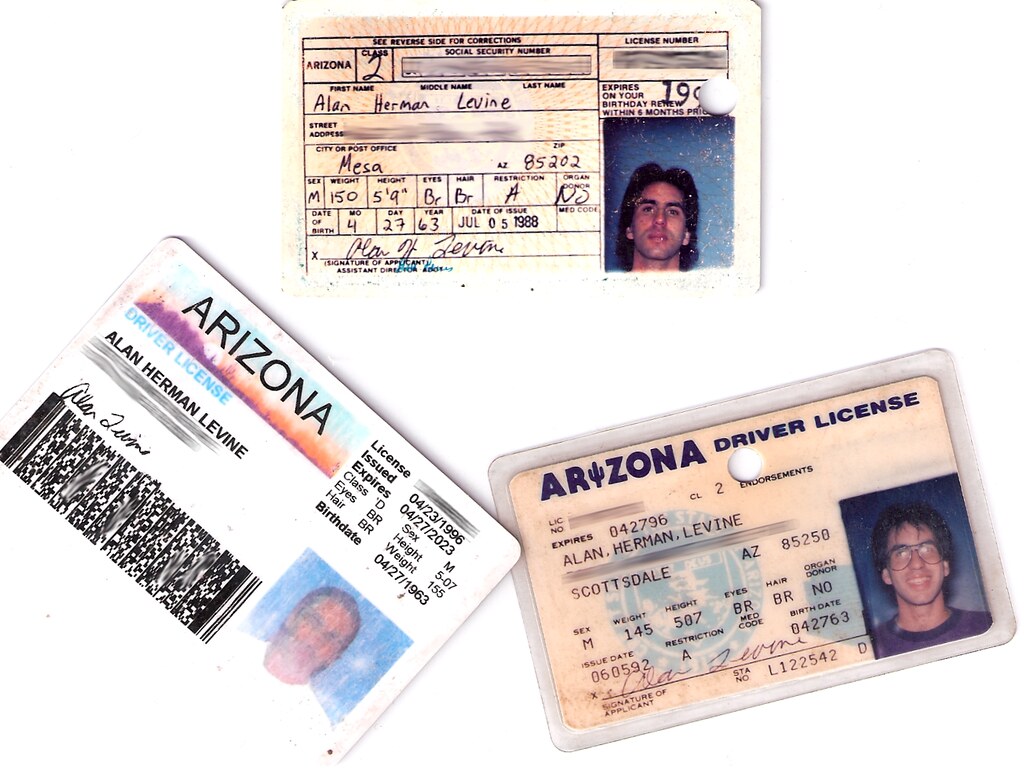

- Driver’s license obtained in the USA (in the case of its absence – the license that is present). Do not forget to report your insurance broker about its receipt in case you didn’t have it at the moment of car insuring;

- Vehicle Identification Number;

- Make, year of release and model of the car;

- The zip code of the place, where the car will be left for night. Every insurance company is having its own rating of safe parking areas.

- There is one more item, which must be specified for insurance company- the approximate number of miles you plan to drive in a year. This data is provided in the form of a non-formal letter. Some insurance companies each year ask for documents that reflect the real state of things. If it suddenly turns out that you greatly underestimate the data, you may need to compensate for the last 3 years. In general, it is worth bearing in mind that any car insurance fraud is a crime and you will be punished for it.

Parameters affecting the cost of the policy

These parameters are taken into account when calculating the cost of the policy for each person separately:

- Age (insurance for those, who are younger, than 25, is significantly more expensive, since the insured driver is in the ‘young driver’ category and, according to statistics, most accidents are made by people under 26 years old, so the coefficients are increased for this category of people)

- Local license (if you are a resident of the state, then you must have local license. Moreover, insurance is much cheaper with it)

- Driving experience (even the experience, which was gained in another country, counts. You just need to send a copy of the license)

- The presence of higher education (discounts up to 10% if there is a diploma (especially if you are an engineer)

- Availability of stable work and high income

- Marital status and having children

- Type of insured car, its age and price, availability of collateral for a car (credit / leasing is 10–30% more expensive)

- Availability of anti-theft systems

- The presence of a garage (when having it, the insurance can come out cheaper)

- Credit history

- Driving history (penalties for the last year, number of removed points for violations (this item is most important, as it characterizes you as a driver)

- Availability of a certificate of the school of emergency driving (in fact, you can read the brochure with the rules online, it can help to get a discount of a couple of dollars)

- The state where you live, and where you will use the car (here the accident rate by states is taken into account)

- The county in which you lived (the accident rate by county, the median income of people living in the county and other less obvious parameters are taken into account)

- Rates of insurance premium payments for the previous year, for example due to hurricanes on the East Coast in the winter of 2016 and a large number of payments, insurance companies increased policy prices from June 2016 for all states.

As many factors influence the cost of the policy, it is best for you to find a professional broker, who will help you choose the policy you need. In order to minimize risks, you should choose services of only large insurance companies or licensed insurance agents. Do not look just at low prices of the insurance company, as it could mean short-term benefits and a possibility of large loss in the event of an unforeseen accident on the road.